One Of The Best Tips About How To Reduce Operating Leverage

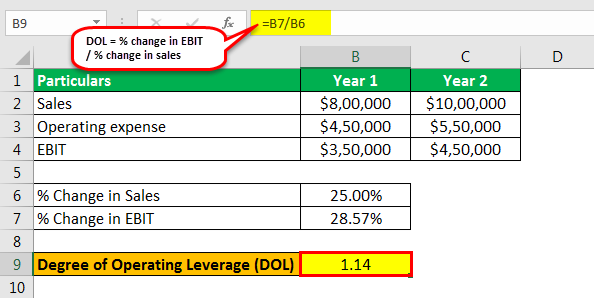

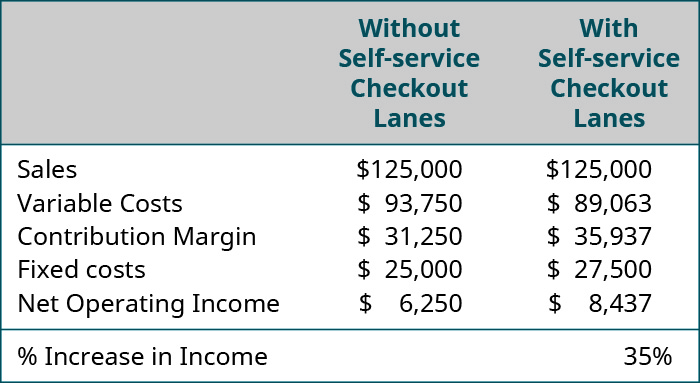

Calculate the change in income by taking this year's income and subtracting the.

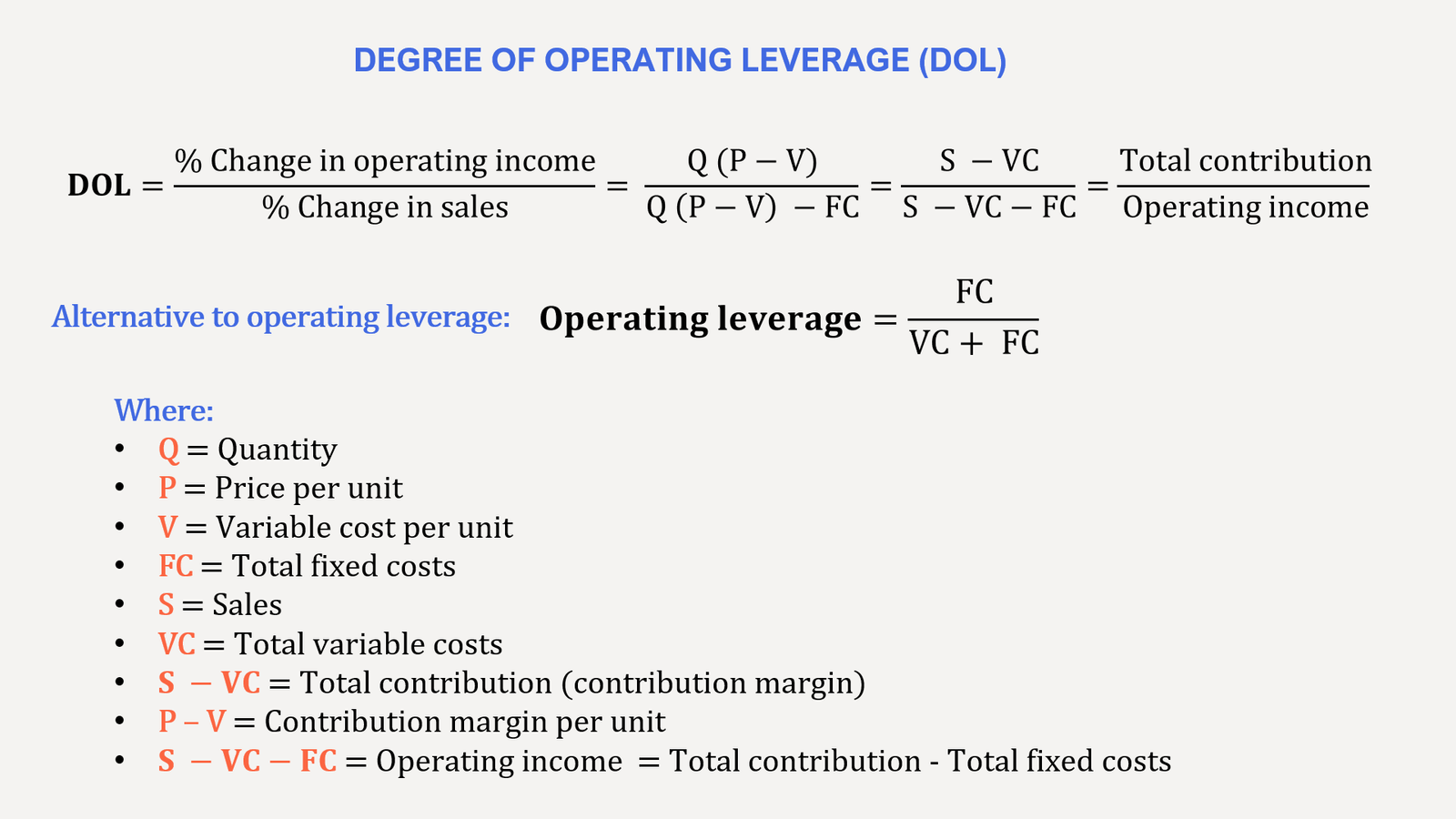

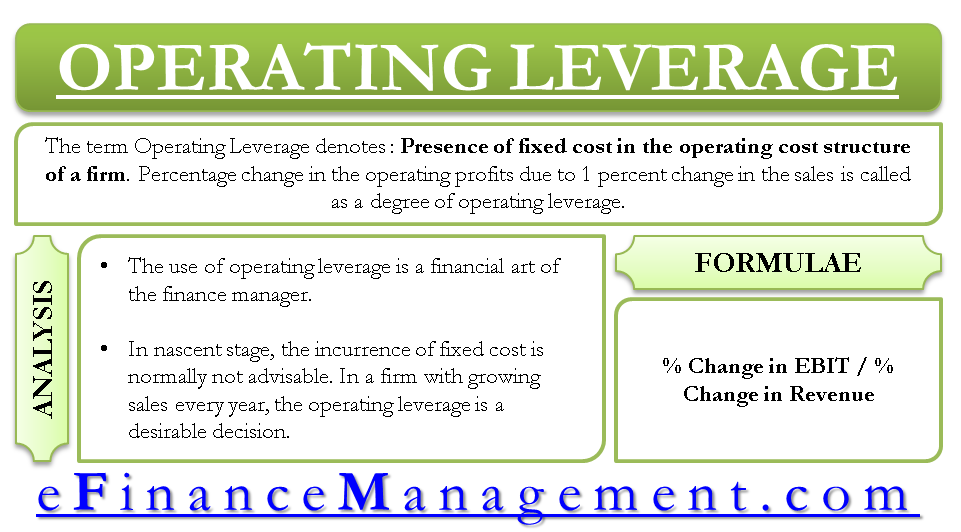

How to reduce operating leverage. Calculation of degree of operating leverage. The better operating leverage a company owns, the quicker the company can scale up as it grows, the lower the leverage; The operating leverage formula is calculated by multiplying the quantity by the difference between the price and the variable cost per unit divided by the product of quantity.

Every business should have a broker who knows the market, helps reduce operating expenses, and advocates for them by creating leverage for their tenancy. Percentage change in sales = change in sales / sales in year 1 * 100%. If you don’t have access to the company’s financial data, you can still calculate operating leverage with an estimated cost ratio formula:

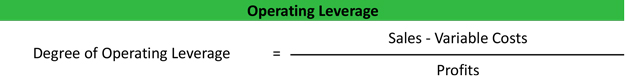

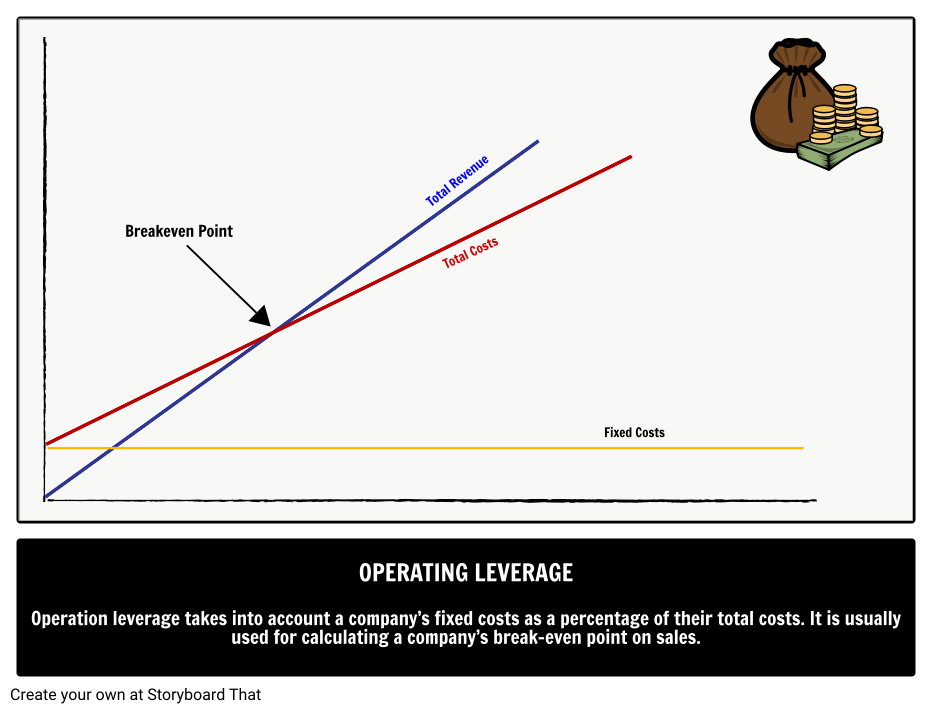

The degree of operating leverage (dol) is a leverage ratio that summarizes the effect a particular amount of operating leverage has on a. Operating leverage = % change in income / % change in sales. = $200,000 / $800,000 * 100%.

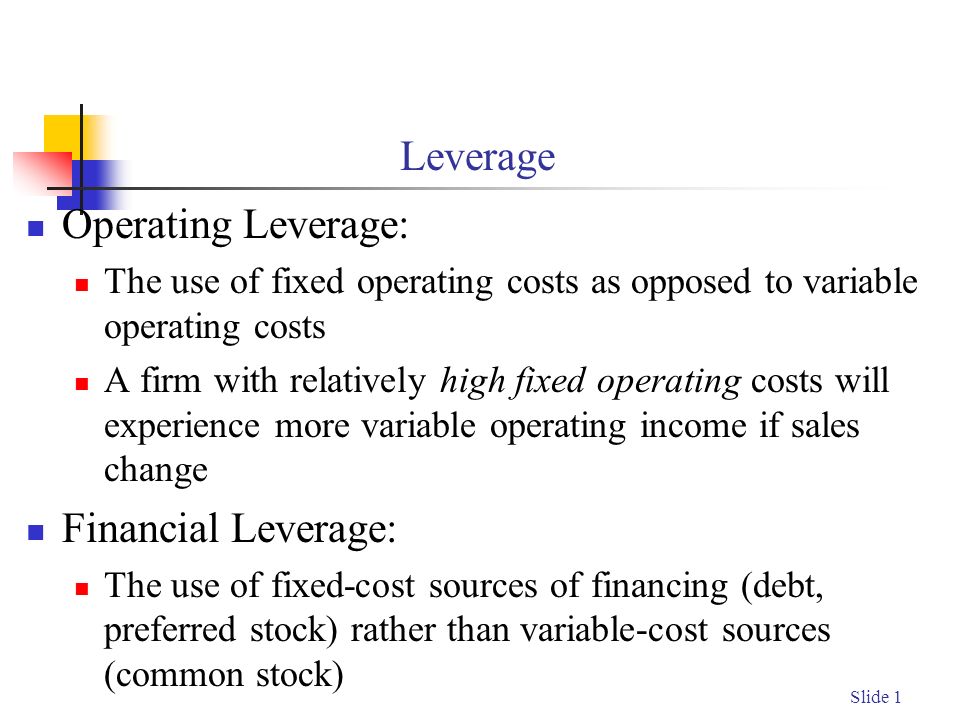

Improving leverage in addition to setting benchmarks for when to increase operating costs, you can improve operating leverage by cutting costs in a way that doesn’t. Leverage ratios indicate how much a company’s. Substitute direct labor for automated equipment.

The opposite is the case. A leverage ratio is a financial ratio of any kind that shows a person or business’s debt against their balance sheet, income or cash flow. This measure is directly proportional to a company's fixed costs.

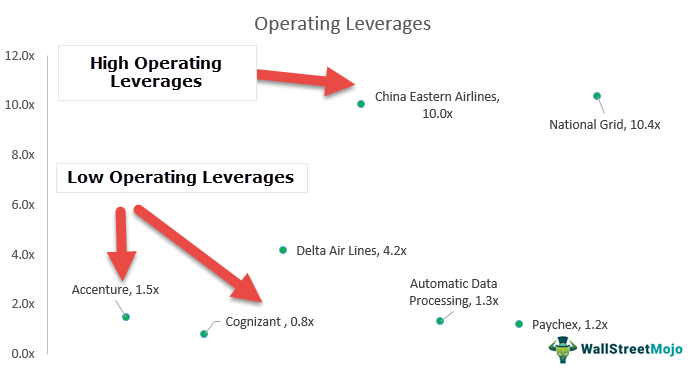

A good 3pl can help you significantly reduce your company’s operating leverage. The best way to reduce operating leverage is to: In contrast, a low operating leverage shows that the company has a lower percentage of fixed operating costs relative to its variable operating costs.